The EB-5 immigrant investor pilot program was introduced in 1990 as a way for immigrants to obtain permanent residency in the United States by investing a required amount of money into a new commercial enterprise to create a minimum of 10 U.S. jobs. When it comes to EB-5, there are two ways for an immigrant to invest his/her money – direct investment and Regional Center investment. The main difference between the two is the way in which jobs can be calculated.

In the direct model, only direct jobs can be calculated. This means that only the jobs associated with workers directly on the company payroll can be counted. Because of this, direct EB-5 investment projects are ideally suited to smaller sized deals that are mostly dependent upon operational jobs. Direct investment projects typically include restaurant, franchise, or individual medical offices where the time frame and cost of construction is relatively small, but the number of employees supports the requirements for the EB-5 program.

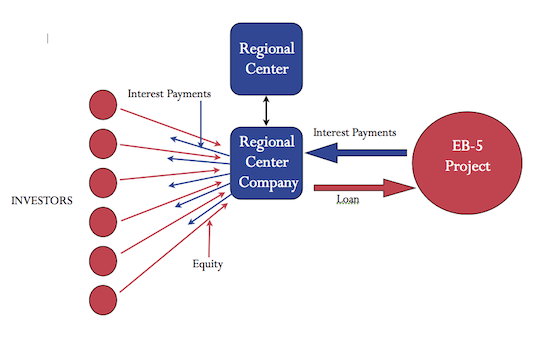

The second option is investing into a project through a Regional Center. The key advantage to a Regional Center investment is that direct jobs and both indirect and induced jobs can be counted. As a result, Regional Center projects tend to be much larger deals involving higher capital costs.

By leveraging jobs created as a result of the entire capital stack, many more jobs are considered to have been created, and therefore, a much larger EB-5 investment can be sustained. Another benefit of investment through a Regional Center is having someone in charge of the immigration tracking process

- managing filing status and paperwork, coordinating communication with investors and their agents, etc.

- and ensuring your project and Regional Center comply with EB-5 requirements. In some cases, the USCIS may even take a first look at the project while the Regional Center application is being approved. Being approved as a Regional Center requires a significant investment in time and money. As with any government program, the process to obtain Regional Center designation is long and complex. Both types of EB-5 investments are accepted by the USCIS. It is up to the investor to conduct his/her due diligence on every project and up to the Regional Center to make sure the money is being invested in the right place.

In our experience, both direct and Regional Center EB-5 opportunities have appeal to investors. Developers interested in EB-5 funding should consider the type of model for the project they wish to do. In some cases, the additional overhead of establishing a Regional Center may be well worth the effort, whereas in other cases the direct investment approach is ideal.